Mastering non-price proposals

Key takeaways

As global governments continue to incorporate minimum requirements, pre-qualification standards, and award non-price criteria (NPC) into offshore wind tenders, the focus is shifting towards enhancing societal value and driving the adoption of renewable technologies. For instance, the EU’s Net Zero Industry Act mandates that 30% of renewable auction volumes in public tenders must address sustainability and resilience factors. This article written by Nathan Meijer & Douwe Velds delves into what this evolving landscape means for organizations and tender teams striving to maintain a competitive edge and deliver winning bids.

We present six essential recommendations for understanding and mastering qualitative criteria in offshore wind tenders:

- Embrace NPC: Recognize the increasing role of non-price criteria in offshore wind tenders and integrate them into your strategy to stay

- Strategically integrate NPC: Leverage NPC as a unique selling proposition (USP) by embedding them into your strategy from the outset.

- Evaluate market attractiveness: Consider the role of tender design in assessing market potential, including government openness, partnership opportunities, and visibility into tender.

- Adopt a collaborative approach: NPC can shift project risk profiles, necessitating enhanced collaboration and robust project controls beyond traditional wind farm development.

- Tailor your strategy: Despite commonalities in NPC across markets, crafting a tailored, project-specific strategy is vital for bid success. Local content, partnerships, and expertise in topical NPC (e.g., ecology) are invaluable.

- Translate ideas into SMART deliverables: Successful bids require not just great ideas but the ability to translate them into Specific, Measurable, Achievable, Relevant, and time-bound (SMART) bids — making bid management and bid writing indispensable.

1 Non-price criteria are here to stay

In the global shift towards sustainable energy, offshore wind power has become a cornerstone in achieving climategoals. Traditionally, offshorewind tenders have focused on price competitiveness. However, with the introduction of the Net Zero Industry Act (NZIA)1, non-price criteria are now recognized as crucial for ensuring project resilience, sustainability, and community benefits. The NZIA requires member states to include NPC in at least 30% of renewables tenders, covering 12 renewable technologies, including offshore wind. Although the use of qualitative criteria in public procurement goes back 30 years, the adoption of NPC in offshore wind marks a significant shift in how renewable energy projects are evaluated and awarded.

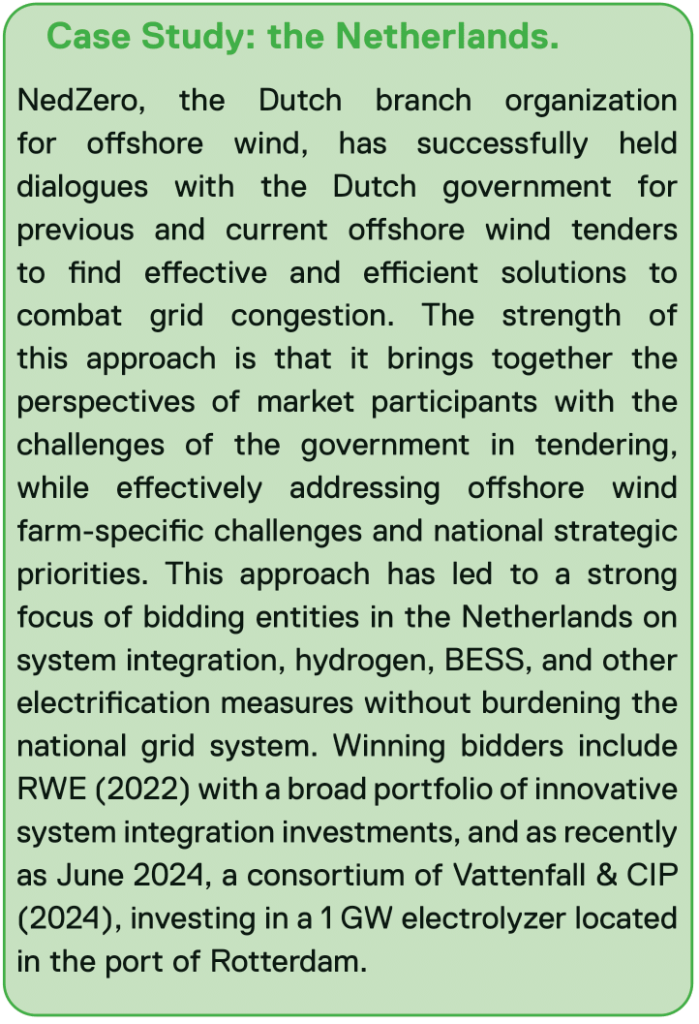

Under the NZIA, each member state is empowered to develop its unique set of NPC and sub-criteria, tailored to address specific challenges and goals for offshore wind projects. For instance, France is expected to emphasize citizen participation, reflecting its commitment to public engagement. Meanwhile, the Netherlands focuses on system integration solutions due to its congested grid, a priority since 2020. These tailored criteria ensure that each project aligns with the unique needs and objectives of the procuring country, fostering innovation and addressing local issues effectively.

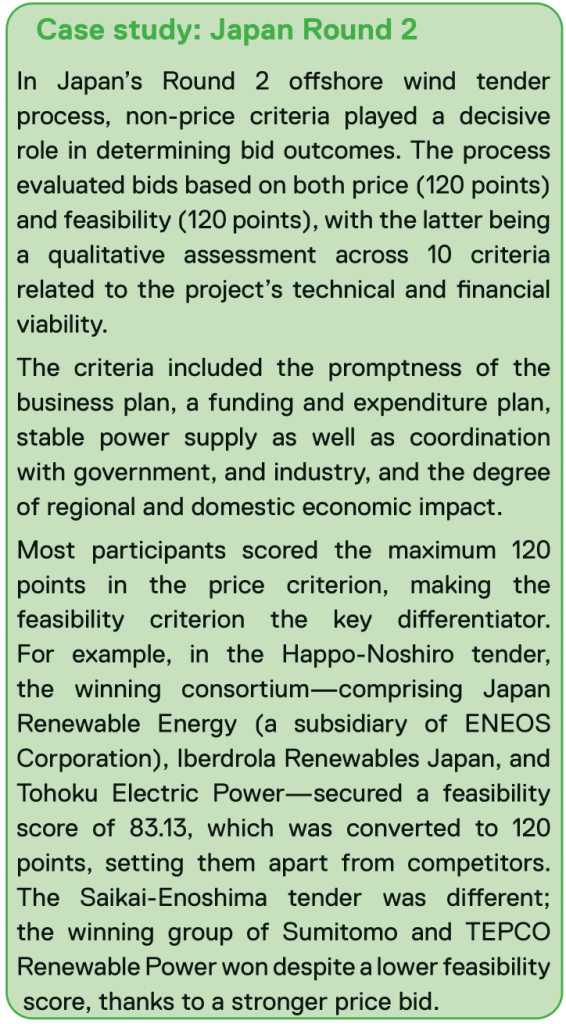

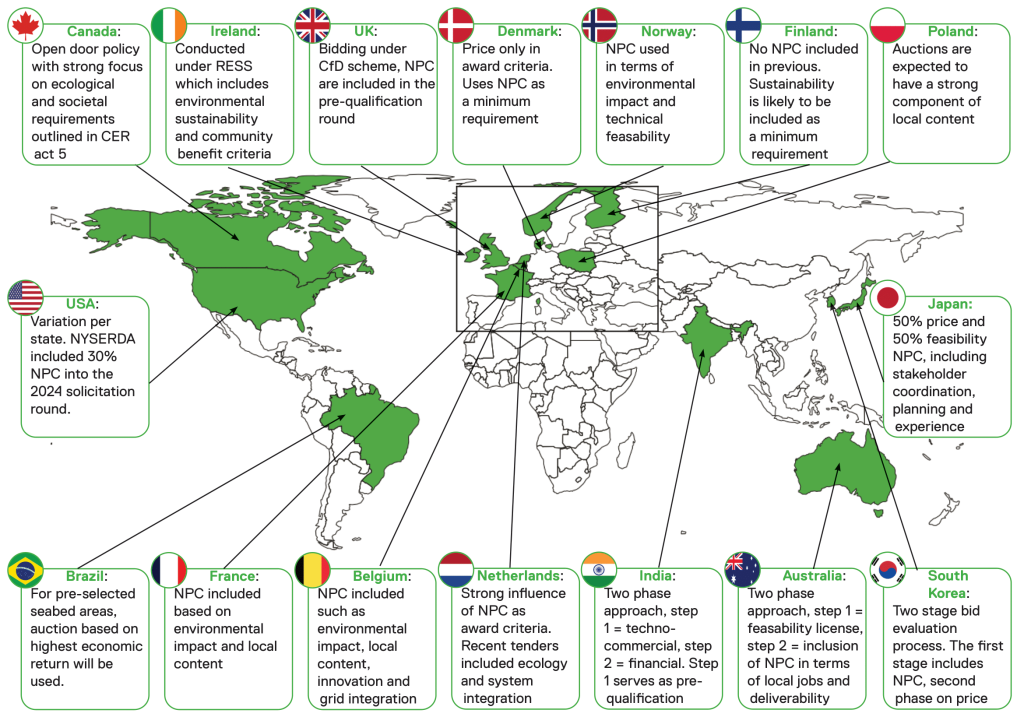

The influence of NPC is not limited to the European Union (EU). In the UK, the Celtic Round implements Sustainable Industry Rewards as part of the bid evaluation process. Australia’s 2023 Portland tender round required qualitative documentation to assess bids comprehensively. In Japan, feasibility criteria, including speed, business plan promptness, track record, and power supply stability, account for 30% of the evaluation. These examples underscore the growing importance of NPC in renewable energy tenders globally. The increasing prominence of NPC in tender evaluations, coupled with industry trends and competitive margins, highlights the necessity for developers to target the right markets.

Success in these markets depends not only on financial competitiveness but also on the strength of qualitative offerings. NPC, such as resilience, social, and environmental considerations, play a pivotal role in determining the long-term success and societal value of offshore wind projects.

This article explores how developers can strategically position themselves to excel in NPC-based bids across global markets. How can developers best prepare for the increased adoption of NPC? What is the impact on an organizational level and for tender teams? How can they consistently deliver winning bids? By understanding and leveraging NPC, developers can enhance their competitiveness across markets, identifying synergies, and realize their growth targets. We aim to provide insights into key considerations for determining market attractiveness based on regional and local NPC, ultimately guiding developers to identify synergies and navigate market differences effectively. Furthermore, as NPC become more decisive in determining the winning bid in renewables tenders, mastering the art of NPC is essential. This article serves as a comprehensive guide to understanding and excelling in this evolving landscape, ensuring that developers can contribute meaningfully to the global energy transition while achieving project success.

2 Understanding non-price criteria

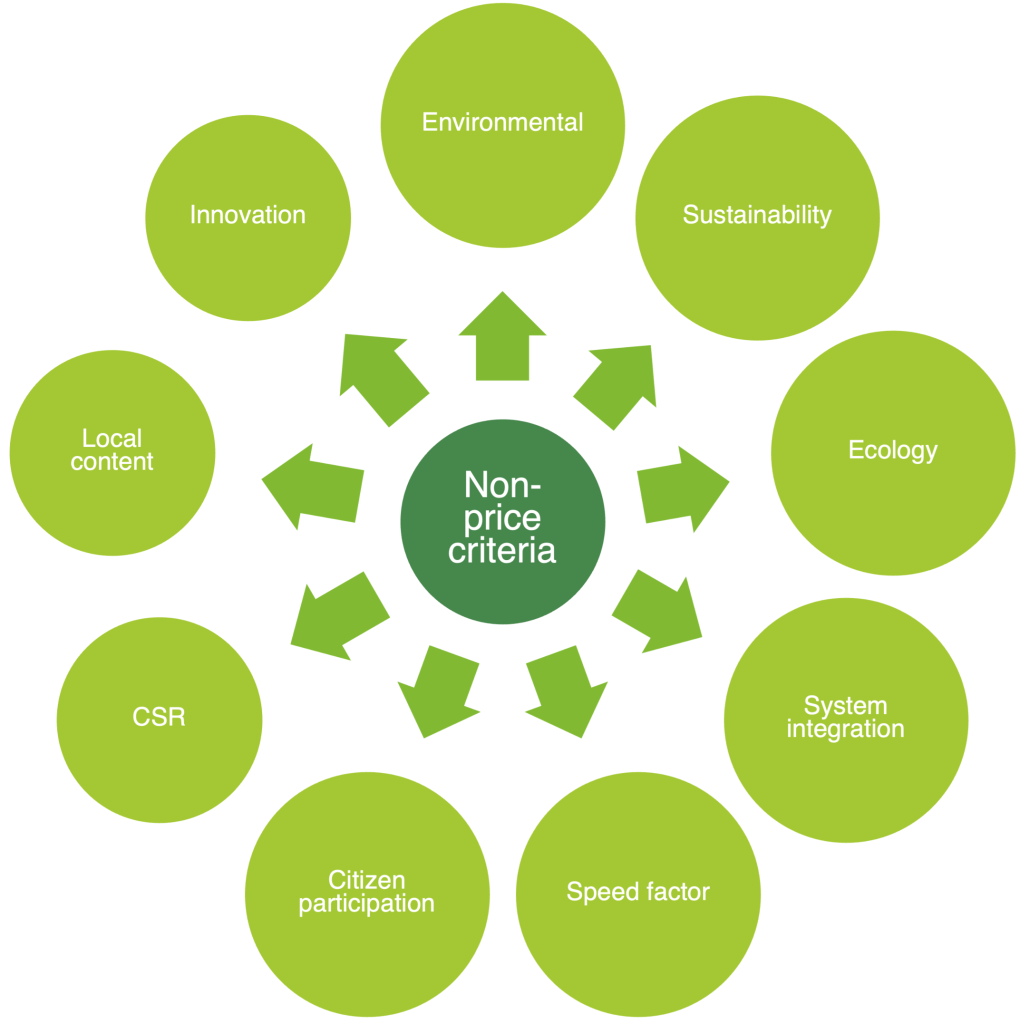

Even though each tender and NPC for each tender is unique, there are plenty of commonalities among the main categories of NPC. The NZIA brings together the main categories, each with a different title or slightly different interpretation in global markets. Below, we describe the main categories, their goals, and implications while providing case examples.

2.1. Minimum requirements, pre- qualification criteria, and award criteria

Non-price criteria can be found in three different stages of a bid. We distinguish three stages: minimum requirements, pre-qualification requirements, and award criteria. Firstly, minimum requirements are basic and essential requirements that must be met for a bid to be considered valid. These characteristics are mandatory for every bidder, set basic thresholds, and are objective and easily verifiable. Secondly, when set as pre- qualification requirements, they can be used to determine whether a bidder has the technical capability, experience, and reliability to perform the contract. They shortlist bidders to increase competitiveness and success rates. Finally, when NPC are used as award criteria, a value- added focus can be integrated into the auction mechanism, such as in the recent IJmuiden Ver Alpha (ecology) and Beta (system integration) tenders. A well-defined1 scoring scheme is required to avoid unnecessary administrative burdens. For instance, certification might be required to prove that bidders meet innovation and environmental standards. To score these criteria, they must be addressed at an early stage by the auctioning authority, in close collaboration with independent experts.

In some cases, as seen in the 2024 Danish 6 GW tenders, NPC are applied as stringent minimum requiremements. These include nature- inclusive design, life cycle assessments (LCA), Environmental Product Declaration (EPD), recyclability of turbine blades, and corporate social responsibility (CSR).

2.2. Non-price criteria focus areas

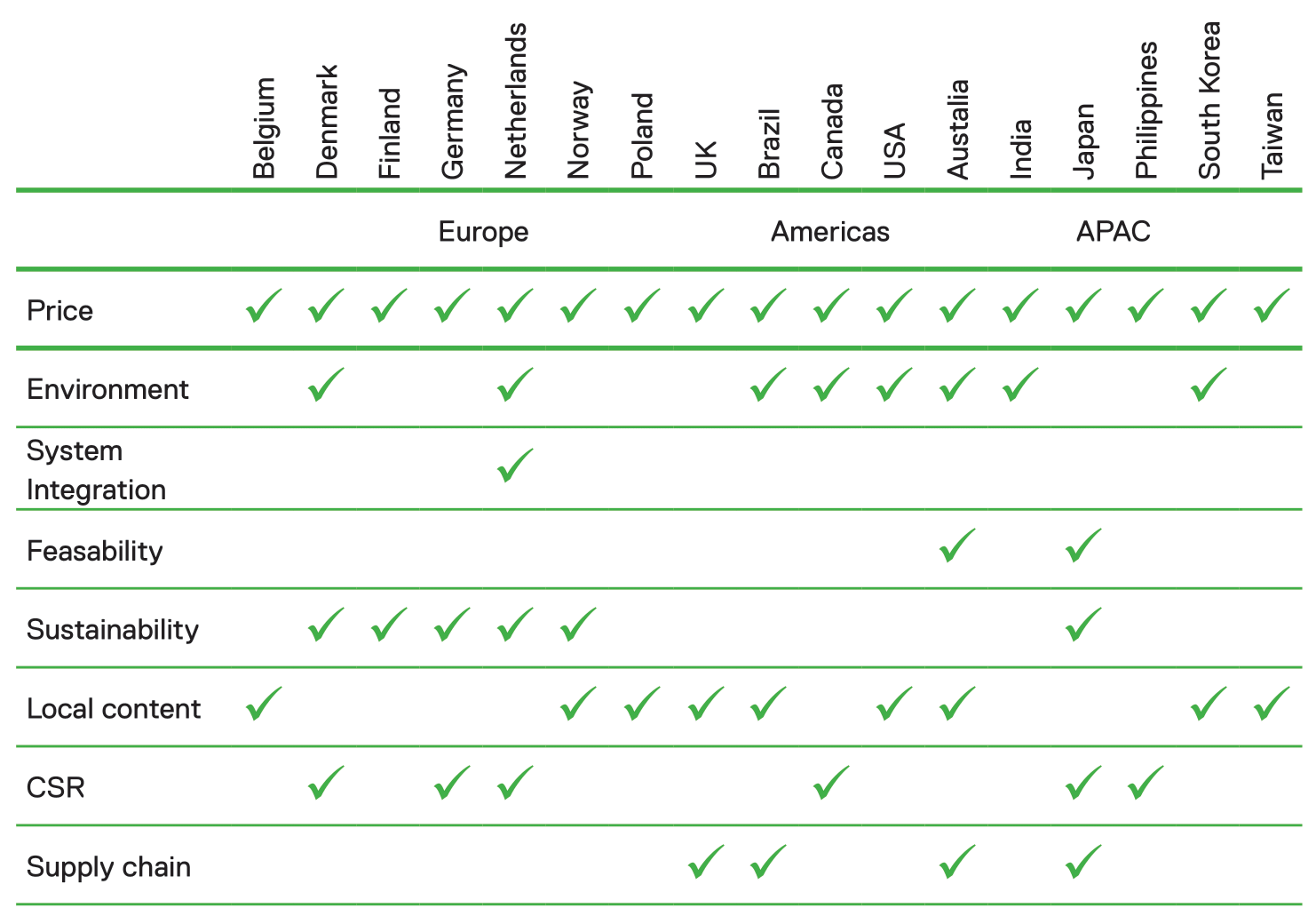

In this section an overview is given of the focus areas per criterion. Although the name of a criterion might change per market, in this article we define five criteria: environment, system integration, feasability, sustainability, and local content. In table 1, the criteria per market can be found.

Environment

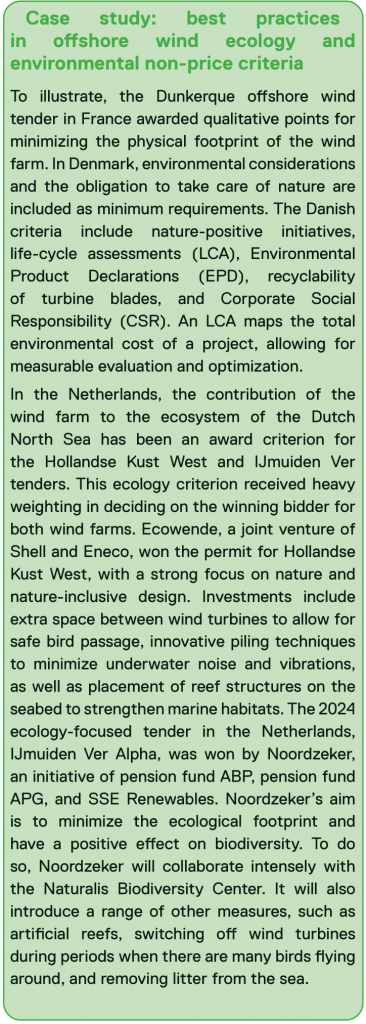

Wind farm installations could impact naturally occurring biodiversity (variety of life) both underwater and above water. For example, seabed disruption, piling noise, light pollution, and bird collisions are concerns that need to be mitigated to develop wind farms in harmony with nature. This NPC awards points for minimizing or mitigating the environmental impact of transport, installation, and O&M activities. Further implementation of nature-related NPC can contribute to a richer ecosystem, especially when applied to multiple wind farms to mitigate the so-called cumulative effects that come with further offshore wind growth. Ecosystems do not stop at borders, requiring a cross-border and collaborative approach. For example, if species migrate and there are mitigation measures applied in one project along their route, but further along the route, these mitigation measures are not applied, the problem remains. To address offshore wind projects, there is a need for collaboration, innovation, and research. Incorporating environmental NPC in offshore wind tenders accelerates ecological innovation. An example of a minimum requirement is the NYSERDA offshore wind solicitation rounds in the US, requiring proposers to implement lighting controls to minimize nighttime visibility and participate in New York State’s offshore wind technical working groups2.

System Integration

A major and rising challenge in several offshore wind markets is solving grid congestion. Renewable energy sources, notably offshore wind, cannot easily be ramped up and down in sync with energy consumption, as most traditional energy sources can to some extent. To put it simply: there is a mismatch between the timing of renewable energy production (electricity) and consumption. Grid systems need to be reliable, stable, and affordable. With rising dependency on renewable energy sources and the growing mismatch between energy production and energy demand, grid systems are having trouble complying with these goals.

The goal of the system integration NPC is to avoid further grid congestion by changing the timing of renewable electricity consumption. Typical solutions include green hydrogen production, battery-energy storage solutions (BESS), and large-scale e-boiler installations. Each technology has its own advantages and disadvantages. Green hydrogen and BESS are becoming more scalable, offering larger potential to integrate (read: take off the grid) large amounts of MW for later usage (read: at moments of high demand and/or grid availability). It is expected that the integration of renewable energy will become increasingly important across markets with high energy demand, grid expansion challenges, and significant growth and share of renewable energy.

For bidders to be successful on the system integration criterion, it is key to show how they will integrate electricity into the national grid system while minimizing potential negative impacts. Typically, the assessment is based on viability (permits, land, timelines), feasibility (how mature and scalable is the technology, risks), and scale (how many MW can be integrated without affecting the grid). In the Japanese Offshore wind round 2 case study, the criteria of a feasibility assessment are explained3.

Vertically integrated developers have a natural advantage with system integration since they can, in some cases, leverage their existing local assets to become “green” and are less dependent on third-party PPAs. This advantage can be offset, though, by entering into local partnerships with large energy consumers or technology providers. Notably, it is key for governments as procurement authorities to ensure a level playing field on system integration NPC. A good example is the IJmuiden Ver tender in the Netherlands, where the tender requirements included the condition that the system integration investments cannot be part of a previously granted permit and subsidy grant. These conditions do not, however, offset the fact that bidders with local assets are less dependent on external PPAs and find it less challenging to finalize a business case in time.

From a business case and risk management perspective, the investments and proposed measures for system integration also leads to an increased risk profile due to dependencies with third parties, usage of less mature technologies, and the costs associated with the investments. The good news is that this risk premium should be compensated with a higher score on the bid evaluation, and thus the chance of making the winning bid. In short, system integration as a non- price criterion is impactful for the developer’s overall organization as well as for the tender team responsible for delivering the proposal, considering that new technologies, partners, and considerations are part of the day-to-day tender process. Strategically positioning on a regional or global basis for system integration can lead to a competitive edge across offshore wind and other renewable technology tenders.

Feasability

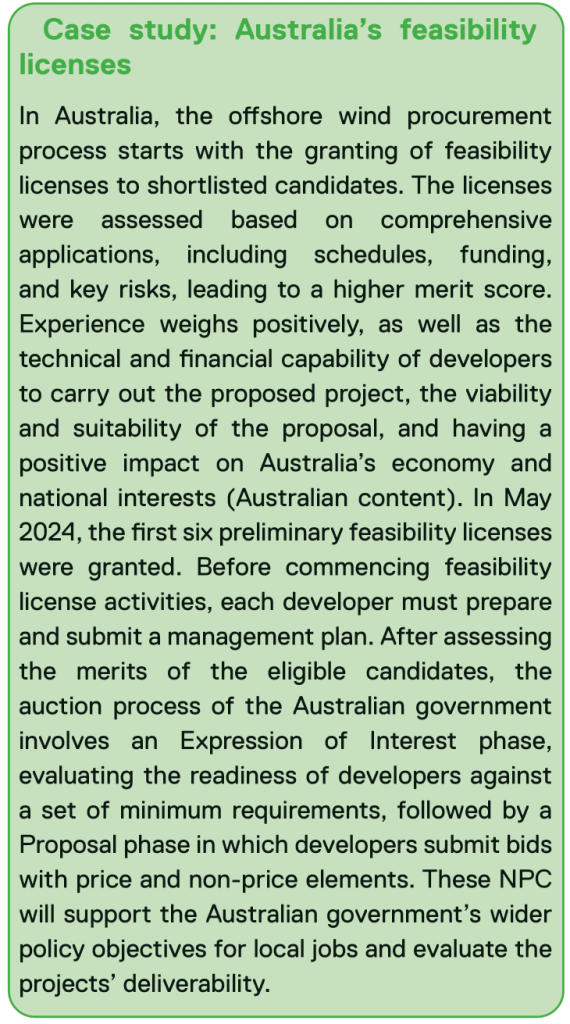

Feasability or the ability to deliver refers to the technical and financial ability of companies or consortia to realize the wind project. A typical pre- qualification criterion, bidders must demonstrate relevant experience, capabilities, and resources to be allowed to bid. From a financial perspective, companies are typically asked to provide proof of their ability to raise debt and funds. This criterion, however, should not limit the ability of new entrants with smaller balance sheets to compete in the tender. Additionally, the ability to deliver can refer to delivery timelines, as long as the timeline remains realistic and robust. The Japanese tender rounds include feasibility scoring in which points are awarded for experience and track record, the business plan, and a funding and expenditure plan. In the US, NYSERDA awards 20% of points to project viability, for which tenderers must demonstrate and substantiate how their project can be expected to be in service on time. An excellent score requires a developed plan that convinces NYSERDA of the technical and logistical maturity of the development phase of the wind farm. Australia’s non-price criteria assessment will involve evaluation against its national policy objectives for local jobs and project deliverability, as outlined in the following case study.

Sustainability and circularity

This pre-qualification or non-price criterion evaluates the extent to which a proposal takes circularity (maximum use and reuse of raw materials), environmental impact, and value retention into account in the design, construction, operation, and decommissioning (removal/ disposal) of the wind farm. Examples of this criterion can be found as a minimum requirement in the recent Danish 6 GW tenders, where it is set that the blades shall be at least 75% recyclable4.

Local content

Another category of non-price criteria relates to broadening access to renewables for more consumers. It awards points to projects that reach out to renewable energy communities, citizen energy communities, or other social entities, or more generally allow consumers to purchase a stake in the project and benefit directly from it. The Princess Elisabeth Zone tender in Belgium is a pioneer by allocating up to 10% of points to citizen participation. Including the wider society as stakeholders in renewables projects comes with challenges such as informing the public about the legal aspects, risks, and opportunities of participation.

Tenders may also be designed to include requirements benefiting local communities and contributing to increased competence and development in the supply chain. In Norway, the Sørlige Nordsjø II tender included positive ripple effects as a minimum standard to be met. In offshore wind auctions in Germany for centrally pre-investigated sites, a contribution to securing skilled workers in the offshore wind industry is included. The Celtic Round 5 tender in the UK asks for a range of plans for skills development, including an apprenticeship plan, skills development plan, and volunteering plan. To deliver high scoring on this criterion, strong local engagement before and during tenders is required in order to enter into partnerships and make investments.

The Japanese tender rounds include feasibility scoring in which points are awarded for regional and domestic impact. In the US, NYSERDA awards 10% of points to New York Economic Benefits, encouraging developers to procure wind farm components and make other associated investments in New York state, resulting in a developed in-state supply chain.

CSR

CSR relates to responsible business conduct, enhanced community welfare and engagement, and stakeholder management. The Celtic Round 5 tender in the United Kingdom by the Crown Estate includes a stakeholder and consenting management plan, underscoring the importance of listening to stakeholder needs and wishes and, to the extent possible, integrating these into wind farm developments.

The IJmuiden Ver Alpha and Beta tenders in the Netherlands awarded points for exercising due diligence compliance with the OECD Guidelines and United Nations Guiding Principles. In Germany, the law governs companies to address human rights- related and environmental-related due diligence in their supply chains. The Japanese tender rounds include feasibility scoring, in which points are awarded for coordination with surrounding industries (fisheries, shipping, and others) and government and authorities.

In the EU, responsible business conduct and CSR are captured in legislation. This includes requirements for companies to carry out corporate sustainability due diligence with regard to deforestation, so-called conflict minerals, and batteries, as well as requirements to disclose sustainability-related information to investors, consumers, and other stakeholders.

Supply chain

A strong supply chain is a key pillar of successful offshore wind markets. Supply chain development can include port infrastructure, vessels, and access to a skilled labor force. To increase supply chain resilience and build competitive industries across offshore wind markets, domestic and regional investments are needed. To illustrate, the UK Celtic Round 5 tender includes an Integration Ports criterion, requiring bidders to provide evidence on which port(s) infrastructure will be utilized, a plan for port usage, and timely and sufficient capacity and access. To deliver winning proposals for the supply chain criterion, a detailed supply chain strategy, supplier engagement, vessel availability, and local content are key.

Another example of stringent supply chain requirements can be found in Brazil. Here, a local content policy is stimulated by the BNDES FINAME program. This caused Western wind turbine manufacturers to open facilities in the country. BNDES previously had a local content requirement that at least 60% of the materials used should be produced in Brazil, though this requirement has dropped to 30% in recent years5.

3 Positioning for non-price bid excellence

3.1. Assessing market attractiveness

As qualitative criteria become increasingly critical in securing project pipelines, prioritizing these factors in market assessments is essential. Key considerations include:

- Government policy and openness: A favorable regulatory environment is essential. Developers should seek markets where the government is supportive of renewables and open to industry consultations. For example, the Dutch government regularly engages with industry stakeholders, including Nedzero, as seen in the case study on the right, to refine tender processes and integrate lessons learned from previous auctions. Interaction with tender authorities helps to better understand their policy dynamics, can create a more favorable regulatory environment, and should ultimately lead to better non-price proposals.

- Tender pipeline visibility: Long-term visibility on tender pipelines allows developers to plan effectively. The EU Commission’s recommendation for member states to announce auction pipelines five years in advance is an excellent example of how clarity in timing and capacity can aid in strategic planning.

- Downstream demand and market potential: Consider the market’s demand for electricity and related products like hydrogen and P2X. Markets with attractive electricity prices and robust support for downstream projects present significant opportunities and lay a favorable foundation for system integration investments.

- Supply chain and partnerships: A strong existing supply chain and opportunities for local partnerships are vital. Developers can conduct gap analyses to identify potential partners who can help meet qualitative requirements and complement in-house expertise while providing invaluable local insights.

3.2. Developing Organizational Excellence

To succeed in markets that emphasize NPC, developers need to cultivate excellence at the organizational level:

- Align organizational goals and strengths align with NPC demands: To make an impact and deliver excellence in NPC-driven tenders, your organization’s goals should be aligned with the specific demands of non- price criteria. By embedding NPCs into your organizational strategy, you not only enhance your competitive edge and USPs in terms of expertise and experience but also demonstrate to evaluators that your bid is grounded in the core strengths of your business. In the current tender landscape, key factors to leverage include expertise in areas such as environmental sustainability, circularity, and ecology, as well as strong planning capabilities and citizen participation experience. These attributes are particularly valuable in markets like the Netherlands, Denmark, Belgium, and France.

- Building the right teams: In comparison to the relatively compact tender teams of price-led tenders, non-price criteria require a multidisciplinary approach involving expertise in the topic at hand, as well as risk management, stakeholder engagement, and technical expertise. Stakeholder engagement is key for managing relationships with key local and regulatory players, adding depth and credibility to your proposals. The aim of qualitative criteria is to maximize value while minimizing cost and risk. Achieving the most effective measures and investments demands creativity, innovative thinking, and strong collaboration across disciplines, leveraging collective intelligence.

- Partnerships and synergies: Strategic partnerships and local alliances are critical for bolstering your NPC proposals. Collaborating with local firms and organizations not only enhances your bid’s relevance but also meets local content and regulatory requirements. By forming these partnerships, you can access resources and expertise that might otherwise be out of reach, creating synergies that lead to innovative and competitive solutions. Gap analyses can help identify areas where external partnerships can fill expertise or resource gaps, ensuring that your non-price proposals are robust and comprehensive.

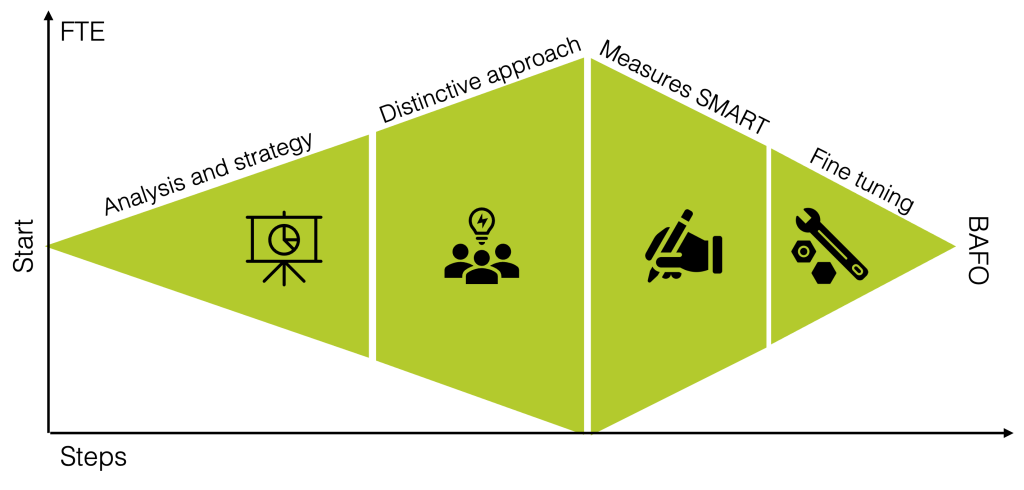

3.3. Crafting winning bids

With a clear understanding of the market and your strategic position, a winning approach to tender submissions can be developed. This involves several key components:

- Bid Management: Preparing for NPC- heavy tenders requires a well-structured approach. Early assessment of strengths and weaknesses in relation to the qualitative criteria is essential identify the need to form strategic alliances. This includes early setup of tender teams, gap analyses to identify deficiencies, and detailed analysis and content-creation phases to meet qualitative requirements. A key aspect of a structured bid process is effective bid writing. Your bid should be Specific, Measurable, Achievable, Relevant, and Time-bound (SMART). Clearly defining what your bid will deliver, including specific project outcomes and benefits, leads to higher scoring potential. Ensure that the outcomes you promise are realistic and achievable based on available resources and timelines. Additionally, developing robust bid management capabilities is critical for success. This includes assembling a cross- functional team with expertise in project management, engineering, finance, and legal aspects, establishing a clear timeline with key milestones for bid preparation, and implementing thorough risk management practices.

Topical expertise: Developers should focus on building expertise in areas of strategic importance, such as environment, sustainability and system integration. Markets like the Netherlands and Denmark place a high value on these attributes. For instance, in the Netherlands, successfully handling grid congestion issues has led to a strategic focus on system integration, resulting in winning bids that incorporate innovative solutions like hydrogen production and BESS.

Download the article: Positioning for Success in Offshore Wind – Mastering Non-Price Proposals

Flux Partners brings more than a decade of experience in managing tenders, projects, contracts, and ESG topics for leading developers, investors, and contractors across the renewables and infrastructure markets. Founded in 2014 with bid management and bid writing for multibillion-dollar projects as our core business, we have continued to improve our tender management process to become what we are today: a leading advisory in the field of tendering, with a strong focus on streamlining tender processes, fostering collaborative environments, and providing topical expertise on non-price criteria to ultimately delivering winning proposals. If you would like to know more about how we can contribute to your projects, please contact us here.